- The Follow Up

- Posts

- The Guy Who Sold $1.8 billion of Insurance

The Guy Who Sold $1.8 billion of Insurance

Sales lessons from the legendary Ben Feldman

Good Morning and Happy First Day of August. We blinked and somehow it’s almost the end of summer and we’re in the back half of 2024. Which also means it’s a great time to follow up with all of those leads that told you to check in later this year. ‘Hey, it’s officially later this year… and this is me checking in. Let’s talk.’ 😃

In today’s Follow Up:

Sales legend: Ben Feldman 💡

A sales email tip of the day 🧠

Happier as a Sales Manager? 💳️

Sales jobs, job market & a meme 😂

The Guy Who Sold $1.8 Billion of Insurance

Picture this... it's 1942, and a 30-year-old Ben Feldman wakes up for the first day of his new career in life insurance sales at New York Life.

Little did Ben know, he would become the greatest life insurance salesman of all time, setting records that would remain untouched for decades.

During Ben’s 50-year career, he sold more than $1.8 billion of insurance and was the first to sell $100M in a single year. At one point, he was single-handedly selling more insurance than 83% of the 1.8K insurance companies in America and closed a record $20 million in policies in a single day.

Ben had something special.

And even if you don’t sell insurance, there’s more than a few things you can learn about sales from Ben. So, in classic Follow Up fashion, we gave the intern a Celsius energy drink last night and told him to find all of Ben’s sales secrets.

Let’s dive in. 👇️

1. Don’t Sell The Product, Sell the Benefits ✅

Ben's approach was simple: ‘Don't sell life insurance, sell what it can do.’

This comes back to the basics of sales. People don’t buy products, they buy what that product can do for them.

Insurance → Financial security.

Landscaping service → Time savings.

A big SUV → Safely transporting the whole family.

But in order to sell the benefit, you need to make the prospect aware of their problem. Ben also had a special method for this…

Disturbing Questions

Ben used what he called ‘disturbing questions’ to challenge his customers and make them aware of the problem they had. A disturbing question is focused on the future. But not the future if they buy…. the future if they don’t.

What happens if they don’t buy insurance and something happens?

Or if they don’t buy your software and continue doing things the old way?

The more you can get the prospect talking about the problem, the more likely they’ll want to fix it.

2. Master of the Basics 💪

Ben's secret to success was mastering the basics.

He spent two hours every night studying insurance products, and sales methods, and preparing for his meetings the next day.

He also believed that the best sales pitches were simple. Breaking down complicated products or services into 1-3 sentences that anyone can understand was key.

If people can’t understand the product, they’re not going to buy it.

This meant that Ben would sometimes spend up to 6 hours just to craft a 30-second pitch. Just like MJ shooting 100 jump shots a day… practice makes perfect.

3. The Grind ⚙️

There’s no way around it. Ben Feldman worked non-stop.

Ben was known to work a minimum of 12+ hours, every day of the week, and almost never took vacations.

Now, we’re not saying you have to do the same to be successful. But we’re not saying it wouldn’t help.

You can see Ben selling live in this video and a breakdown of how he thought through the pitch.

What's your favorite Ben Feldman sales technique? |

This painting sold for 8 million and everyday investors profited

When the painting by master Claude Monet (you may have heard of him) was bought for $6.8 million and sold for a cool $8 million just 631 days later, investors in shares of the offering received their share of the net proceeds.

All thanks to Masterworks, the award-winning platform for investing in blue-chip art. To date, every one of Masterworks’ 16 sales out of its portfolio has returned a profit to investors. With 3 recent sales, investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but The Follow Up readers can skip the waitlist with this exclusive link.

Past performance is not indicative of future returns, investing involves risk. See disclosures masterworks.com/cd

Sales Tip of The Day 💡

When writing a cold email, avoid broad claims and be specific.

❌ We help companies like yours save money on their data costs.

✅ We reduced Dunder Mifflin's data bill by 37% last month.

❌ We help companies get a better view of their employee’s spending.

✅ Dunder Mifflin started using our virtual employee’s credit cards last month and reduced their business expenses by $300/employee.

Using specifics tells the story of why your product is valuable, and stands out from the rest of the broad claims in their inbox.

Sales Around The Web 🗞️

💼 Jason Lemkin answers the question: If you hate selling, would you be happier as a Sales Manager?

👀 Attio put 50+ GTM leaders on Nasdaq's board in Times Square to promote their AI CRM.

🏅 A former Olympian turned Sales Leader discusses why sales is such a natural fit for athletes.

📞 Sales reps share the best jokes they’ve ever told one of their prospects.

Cool Sales Jobs 💼

Business Development Rep @ Suvoda

Associate Account Executive @ SalesIntel

Commercial Account Executive @ Rocket Chat

Account Executive @ Fubo

Checking In On The Job Market

How would you answer this...? 🤔

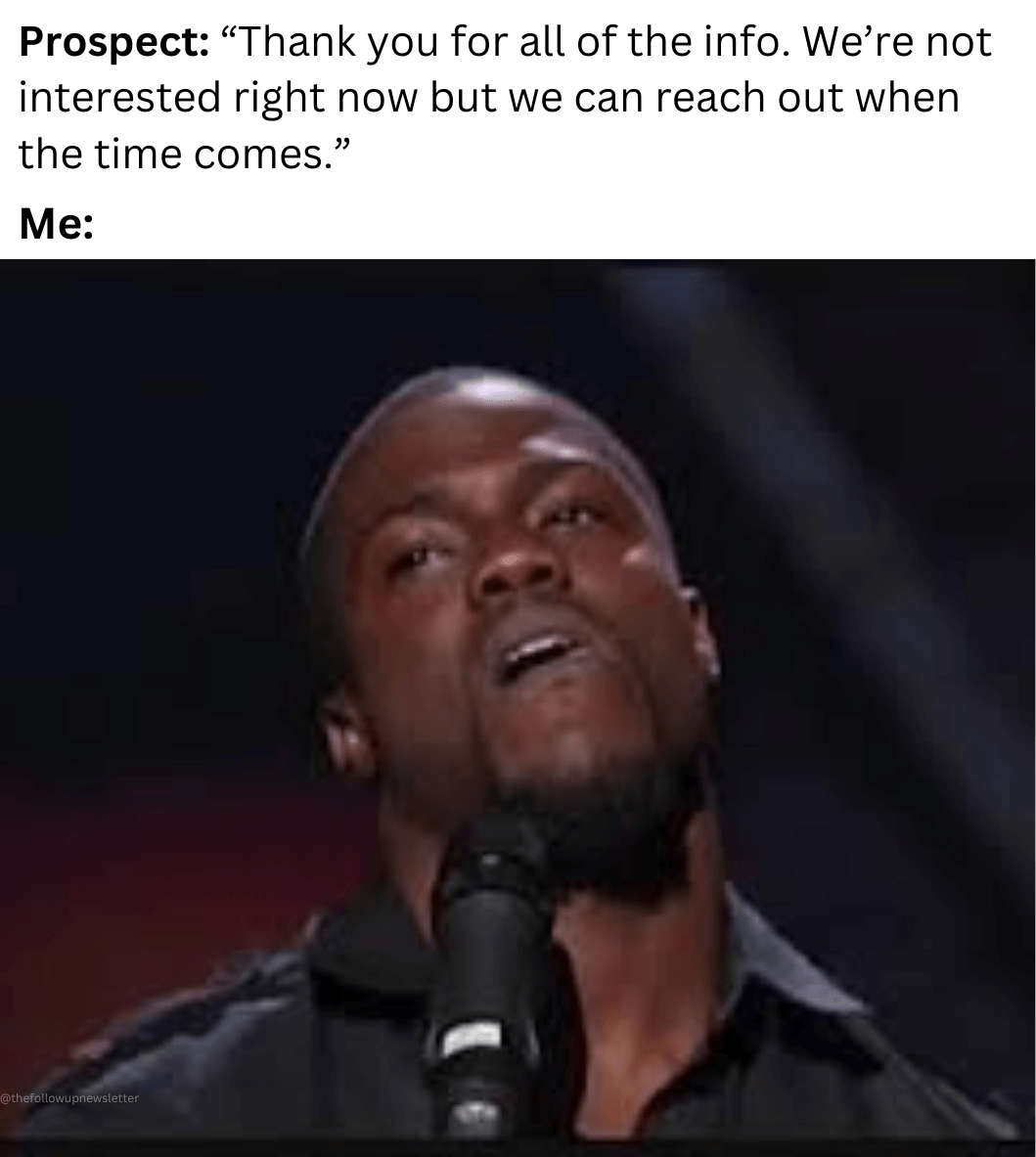

Sales Meme of the Day

What did you think of today's newsletter? |